|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

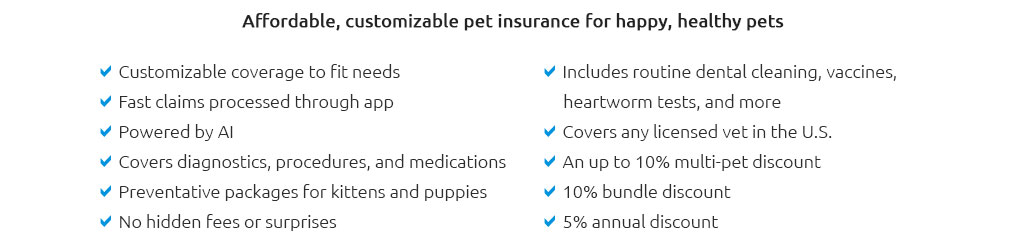

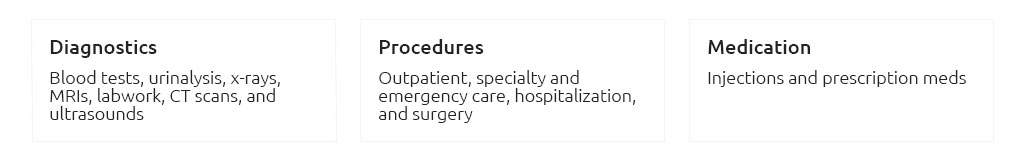

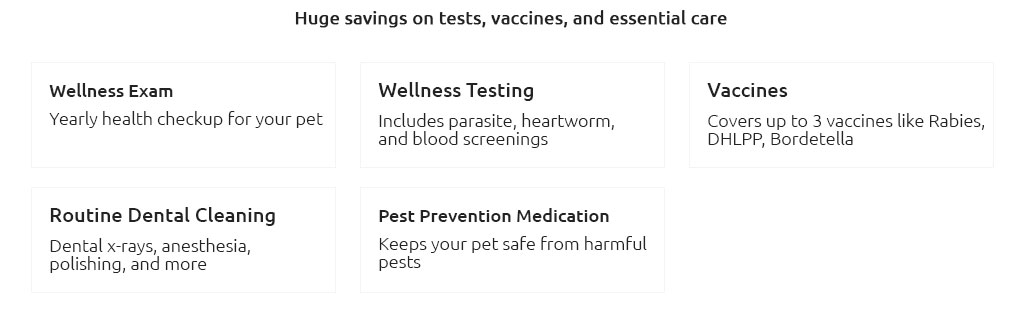

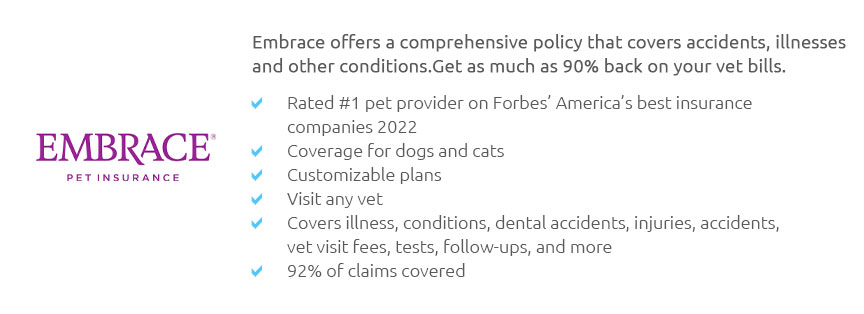

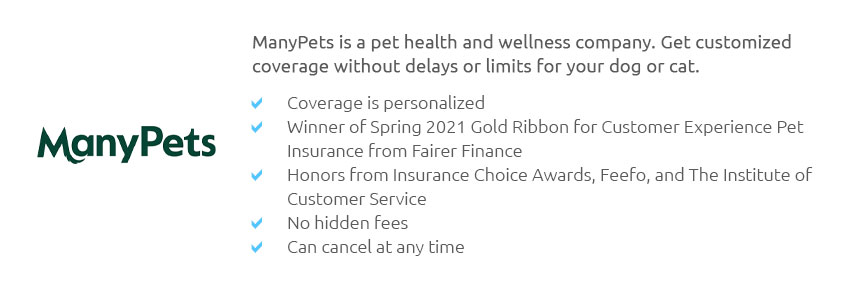

Understanding Pet Insurance in Colorado Springs: A Comprehensive GuideIn the scenic enclave of Colorado Springs, nestled at the foot of the majestic Rocky Mountains, pet ownership is more than a pastime-it's a cherished way of life. As residents of this vibrant city, we find ourselves surrounded by an abundance of natural beauty, and with it, the unique challenges that come with safeguarding our furry companions. Pet insurance is a topic that has increasingly found its way into our conversations, and rightly so. While the concept may initially seem as perplexing as the winding trails of Garden of the Gods, understanding its nuances can be as rewarding as a serene stroll through Palmer Park. At its core, pet insurance operates on principles similar to human health insurance, offering financial protection against unexpected veterinary expenses. For many pet owners in Colorado Springs, this means not having to choose between their pet's health and their financial well-being. But how does it work exactly? Let's delve into the mechanics. Most pet insurance plans involve paying a monthly premium, which varies based on factors such as the pet's age, breed, and health history. When a pet requires medical attention, owners typically pay the vet upfront and then submit a claim to their insurance provider for reimbursement. The reimbursement percentage and the deductible-an amount you pay out of pocket before the insurance kicks in-are critical components that determine the plan's overall value. In Colorado Springs, where outdoor adventures are a way of life, pets often engage in activities that put them at risk of accidents and injuries. Comprehensive coverage becomes essential here, offering protection not just for accidents but also illnesses, hereditary conditions, and sometimes even wellness visits. Companies like Healthy Paws and Trupanion are popular choices among locals, known for their extensive networks and customer-friendly policies. However, the best policy for any pet owner is one that aligns closely with their pet's specific needs and lifestyle. What should a pet owner consider when choosing a plan? It's crucial to weigh the premium costs against the coverage provided. Some plans may offer lower premiums but have higher deductibles or limited coverage. Additionally, consider the waiting periods-time frames during which coverage for certain conditions is not available. While it might be tempting to opt for the cheapest plan, remember that the goal is to ensure your pet receives the best possible care when they need it most. Also, examine if the plan covers breed-specific conditions, as certain breeds are predisposed to specific health issues. For instance, the warm-hearted Bernese Mountain Dog might be susceptible to hip dysplasia, a condition that can be costly to treat without proper insurance.

In conclusion, pet insurance in Colorado Springs is more than a financial safety net; it's a commitment to ensuring that our beloved animals live their lives to the fullest, enjoying every adventure that this breathtaking city has to offer. As we explore the endless trails and vistas with our pets by our sides, knowing that we have safeguarded their health brings peace of mind. By carefully selecting a pet insurance plan that meets your pet's unique needs, you can embrace each day with confidence, knowing that you are prepared for whatever path lies ahead. https://www.tcvetcenter.com/resources/client-portal/pet-health-insurance/

Tender Care Veterinary Center recommends Trupanion Pet Insurance for accidental and medical coverage. These plans do not cover routine preventative care. https://ponderosavetclinic.com/pet-insurance/

We're here to break down how pet insurance works and if it's worth it for your cat, dog, or other pet (pet insurance can cover various animals, including birds ... https://www.reddit.com/r/ColoradoSprings/comments/1g8s50u/what_pet_insurance_do_you_guys_use_if_any/

Second Trupanion. Their monthly rates have gone up for us each year but in the last year alone they've covered thousands. Their customer service ...

|